Bitcoin (BTC) has left gaps along the way throughout its futures trading history. Most of the time, these gaps were filled regardless of whether the price had to move up or down to do that. In the recent past, BTC/USD left five gaps. Four of those gaps have already been filled but the one shown in yellow has yet to be filled. When BTC/USD shot up above $6,425 on a weekend, it was expected that this gap would be closed on a trading day. Sure enough, the price crashed to fill that gap although it bounced up strongly soon after

Bitcoin (BTC) has left gaps along the way throughout its futures trading history. Most of the time, these gaps were filled regardless of whether the price had to move up or down to do that. In the recent past, BTC/USD left five gaps. Four of those gaps have already been filled but the one shown in yellow has yet to be filled. When BTC/USD shot up above $6,425 on a weekend, it was expected that this gap would be closed on a trading day. Sure enough, the price crashed to fill that gap although it bounced up strongly soon after the gap was filled. Bitcoin (BTC) has now left another gap when it shot up from $7,178 to $7,907 on a weekend. This move left a lot of retail traders excited that got onboard but the professionals held back in anticipation of the gap being filled.

The thing about gap in most markets is that they get filled eventually. Sometimes the price goes up a lot higher and then has to come down to that level but the gap does get filled. In this market, considering that the level of manipulation is a lot higher, we have seen gaps wider than we mostly see in other markets. That being said, gaps take shorter to fill in this market. Bitcoin (BTC)’s recent futures trading history is a testament to that as we have seen gaps filled a lot quickly. Smart money takes such gaps very seriously which is why it seldom gets onboard unless the gaps are filled. Bitcoin (BTC) is therefore likely to come down and fill that gap in the near future. While we do expect the gap to be filled, it does not mean that the price will start rallying after it fills that gap.

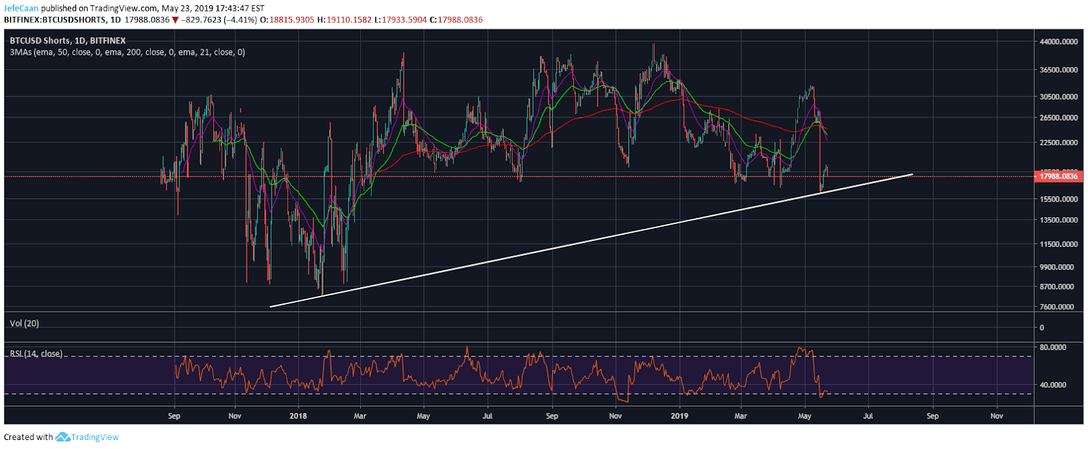

Chart for BTCUSDShorts (1D)

To the very contrary, we have seen signs of a bearish reversal. So, if the price comes down to fill that gap, it might stay and trade sideways for a while before it falls further. Bitcoin (BTC)’s long term outlook suggests that this might not be a good time to buy despite the fact that BTC/USD has already seen an extensive correction and is still down more than 60% from its all-time high. That being said, we cannot ignore the fact that majority of the trading volume on exchanges comprises of wash trading. Blockchain Transparency Institute has a website dedicated to showing the actual trading volume of cryptocurrencies and the difference is mind blowing.

Bitcoin (BTC) is one of the greatest inventions of all time as it solves a very big problem. In fact, it can be said to be an improvement on gold in some ways as it is easier to transfer, store and is more secure. That being said it cannot be called digital gold just yet and for good reason. Any sensible investor who is not in Bitcoin (BTC) and watching the current price movements can tell what is going on. A few big players are playing the small guys as they keep on selling them the dream to get rich quick. No wonder people like Warren Buffet and Charlie Munger have called it rat poison and scam. They might not know how the technology works and how remarkable Bitcoin (BTC) is in itself but they do know the game that is being played and they have seen how it ends.